Enterprise Resource Planning

Our team has a good experience in Microsoft Dynamics 365 Business central implementation as the technical and functional consultant and project management. We managed to implement the Business Central in the different industries in the Middle East and would like to share some of the achievements in the following:

According to our experience, companies are struggling to manage their issues and challenges. Some of the most important issues are as follows:

1) Managing the master data (single source of data): in these days, data is considered as the most valuable assets. Because , it is highly reusable and it can be reused multiple times for a variety of uses. On the other hand, many companies are managing their master data in different applications and excel files and they are holding by different employees, and if the employees leave the companies, some of key data might be lost. As a result, companies have some issues to manage their master data, properly. Moreover, it is better to rely an integrated system rather than the individuals. Besides, companies intend to aggregate business data to improve decision making.

2) Improving the organization effectiveness: It is extremely obvious that every organization would like to enhance their efficiency, productivity and effectiveness and they are looking for some possible solutions to achieve the goal.

3) Item tracking: Companies intend to benefit from a complete history of items and their are looking for a solution to tackle theses questions as fast as possible. when and how many items did we order? when and how many item did we purchase? when and how many items did we consume in the production lines? when and how many items did we sell?

4) Consumption Management: it plays a significant role for the manufacturing industries. Materials is considered as one of the three main factors for the Cost of Goods Sold, and it is pivotal to manage the consumption from the perspective of a quality manager or a financial manager.

5) Identifying the bottlenecks of the processes and root causes of the problems: The organizations would like to find a solution to manage the mentioned issue.

6) Having a precise COGS in a real time way: The organizations would like to benefit from an accurate Cost of Goods Sold or Cost of Services Sold for every production order or service order. in the competitive market, it is important to achieve the goal if the companies intend to improve their profits and the market share.  Microsoft Dynamics 365 Business Central provides a lot of capabilities and we assure that the aforementioned issues can be tackled with the help of this amazing application. It has an excellent user interface and releases up to date versions with new features in a regular intervals. All the function of an organization can be done with a single software. Reports will be always accurate as long as the data is fed accurately. The solution is integrated and can be easily customized.

Microsoft Dynamics 365 Business Central provides a lot of capabilities and we assure that the aforementioned issues can be tackled with the help of this amazing application. It has an excellent user interface and releases up to date versions with new features in a regular intervals. All the function of an organization can be done with a single software. Reports will be always accurate as long as the data is fed accurately. The solution is integrated and can be easily customized.

The key Process of ERP

The processes management plays a significant role in the organizational effectiveness. In other words, every organization has some processes which returns the valuable outputs. The final output is the same products or services for the organization. On the other hand, the organizations attempt to improve their quality of products and services to earn the customers satisfaction in the competitive market. The better companies manage their processes, the more achieve their customer satisfaction. As a result, if you would like to improve the organizational effectiveness, you should manage your processes, properly. Fortunately, Business central provides their processes according to the best practice from a perspective of a functional or a technical. Our team can help your organization to deploy your key processes based on the best practice in order to enhance the organizational effectiveness. For your purchase operation, every purchase order should be created based on a requisition/planning worksheet. I will explain the planning engine in business central in the following. However, it is possible to create the purchase order manually. In this step, the procurement department should check the vendor No, order date, the purchase type, the quantity, the unit cost and the other related fields. It is extremely recommended that to enter the unit cost as the expected cost, because if the unit cost is not entered, the system probably consider it as a zero amount and it might ruin the cost calculation. however, when the finance department invoices the purchase order, the system will adjust the wrong cost and everything will be correct. But, if you would like to benefit from a real time COGS, it is best to enter the unit cost, accurately. After that, the warehouse department should receive the quantity at a particular date and finally the finance user should invoice on the same purchase receipt and its related purchase order. According to the best practice, the purchase order will be open unless the order quantity, the received quantity and invoiced quantity are matched together and this is called 3 way matches.

The production order should be created based on the planning worksheet, Material Requirement Planning and Manufacturing Resource Planning. However, you can create it manually. In the next step of the process, the manufacturing user should post the actual consumption and output one by one in the production journal. Besides, the starting time, ending time, stop code, stop time, sub category of stop code, scrap and the other related information should be posted by the user. After that, the factory manager/planner manager should compare the expected quantity with the actual quantity to be sure the posted data is correct or not. If everything is OK, he can finish the released production order, if not, he should post a correct data. Be careful you need to apply the correct application to the wrong application. If you do not apply, the system probably is assumed the correct consumption as a positive quantity and it might manipulate the item cost calculation. Hence, if you run the production operation based on the best practice, you cannot only control your consumption but also benefit from an accurate Cost of Goods Manufactured. Moreover you can control the manufacturing KPIs such as Availability, Performance, Quality and OEE.

For the sales operation, sales order should be created based on the customer demand. After that the warehouse user should ship the items and finally the finance user should invoice on the same sales order and its related to the shipment.

Financial Module

In Business Central, every operation impact on the financial account. If you would like to run the BC, you need to setup the financial module. If you do not setup, the system stops you and push you to setup the chart of account, the posting group and the posting setup based on the related operation. First of all, you need to setup the chart of account. There are various account categories including assets, liabilities and equities which are placed in the balance sheet group and income, expenses and COGS which are placed in the income statement group. Another key configuration is the posting group. Each defined posting group goes to a particular account in the chart of account. You can save your time and avoid mistake when you post the transaction. There are different posting group in BC including general product posting group, general business posting group, vendor posting group, customer posting group, employee posting group, bank posting group, inventory posting group, VAT posting group and etc. You can create the different vendor posting group as long as you like. For instance, for your domestic vendors you can create a domestic vendor posting group and after that you need to specify the account payable for that, and in your purchase operation, Business Central can generate the related entries automatically. The posting setup is a matrix that determines where everything goes. Let me give you an example to be cleared. In general posting setup you need to create a combination of the general product posting group and the general business posting group. In the product side you determine what you are buying from or selling to and in the business side you specify who you are buying from or selling to. For a purchase operation, you need to specify the purchase account, inventory adjustment account and direct cost applied account.

Item charge

Some of the expenses such as the freight and transportation must aggregate at the posted purchase receipt. In the purchase order, you need to select item charge as a the type, then you should enter the cost and finally you need to assign the expenses to the posted purchase receipt. The expenses can be distributed equally or based on their amount.

Fixed Assets

There are three important types of fixed asset type including acquisition, appreciation and depreciation. Before running your operation, you should create your depreciation book and also setup the fixed asset posting group. In the fixed asset card you should determine the fixed asset No, the depreciation method, fixed asset posting group and the other related information.

Expenses management

As I mentioned earlier, one of the main account categories is the expenses. there are some characteristics which cannot be placed in the expenses, however for the cost analysis and cost of goods manufactured, you need to define the dimensions such as cost type and cost center and you should make those mandatory on your expenses accounts. In our projects, cost type is direct cost or overhead cost. The cost center can be administration, manufacturing or salles. When you intend to post the expenses, you are forced to register your dimensions. According to the financial standard, some of the expenses should be excluded for the COGS. For example, the part of overhead cost which are related to the sales or administration must be excluded from the Cost of Goods Sold. On the other hand, for each work center you need to estimate the direct cost and overhead cost. When you post the production order, the direct and overhead cost applied are credited. As a result, you have 2 parallel ways for your cost. The estimated cost and the actual cost. It is obvious that you need to analyze them and compare together and re-estimate the work center setup in order to have a precise COGM and COGS in a real time way. The mentioned method entails using analysis view, exporting to the excel files and it takes a few minutes to get the results. Fortunately, business central is equipped with the cost accounting module which can automate your analysis and save your time and reduce the dependency on your excel processes. You can create the chart of cost type which can come from your income statement accounts, the chart of cost centers and cost object which can come from from your dimensions. In the next step, you can create the cost allocations and determine how to be allocated the cost from the cost type to the cost centers and the cost object. It can be done in a static or dynamic way. Therefore, you already have your cost allocation and your cost analysis is provided, automatically.

Budget

In Business Central you can create the G/l budget to have a roadmap and control the actual cost and identify the bottlenecks and deviation of your budget. It is possible to specify the dimensions for your budget. You should create a matrix and its lines can be the G/L accounts and its columns can be the date. You can also filter on your date, G/L account and your dimensions.

Cash flow

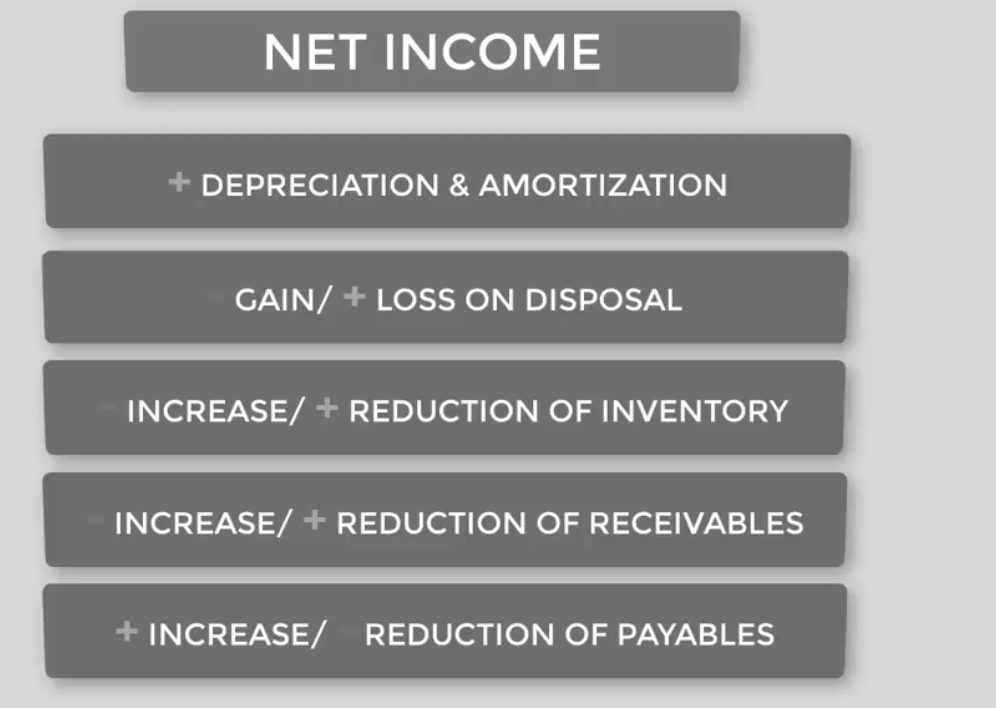

There are three pivotal financial statements including balance sheet which shows assets, liabilities and equities, income statement which represents the net income and cash flow which illustrates the cash movements from operating, investment and financial activities. Fundamentally, managing the cash flow is key for any successful business. The point is that the cash flow is absolutely different from the bank balance. Moreover, profit is different from cash. In other words, the earned revenue is not necessarily the same cash in and the incurred expenses is not the same cash out. You can understand how cash leaving or entering in the business. If you would like to earn the ending cash, you need to calculate the beginning cash, CF operations, CF financing and CF investing. For earning CF operating, you can get your net income and then do some adjustment to achieve that. For instance, the depreciation has been calculated in the income statement and the net income has been reduced by the depreciation. In this example, you should increase the absolute of the depreciation to the net income. The table below shows how to adjust the net income to earn CF operating.

Reporting

There are lots of tables in business central which can help the managers and analysts to benefit from. General ledger entries, item ledger entries, value entries, vendor ledger entries, customer ledger entries, bank ledger entries, VAT ledger entries, employee ledger entries, etc.

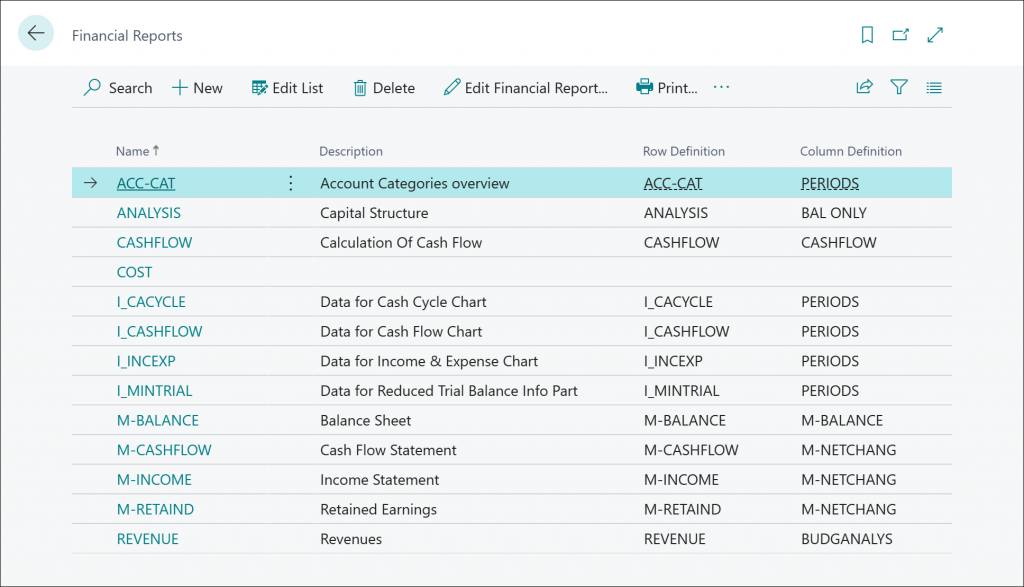

Also, you can create your customized financial reports as long as you like. For example you can create the income statement, balance sheet, cash flow statement and the other financial reports. You can create your row and column definition and also it is possible to combine it with your analysis view. For instance, the sale department cost must be excluded from the COGS and to do that you need to combine your financial report with your analysis view.

Also, you can create your customized financial reports as long as you like. For example you can create the income statement, balance sheet, cash flow statement and the other financial reports. You can create your row and column definition and also it is possible to combine it with your analysis view. For instance, the sale department cost must be excluded from the COGS and to do that you need to combine your financial report with your analysis view.

Planning

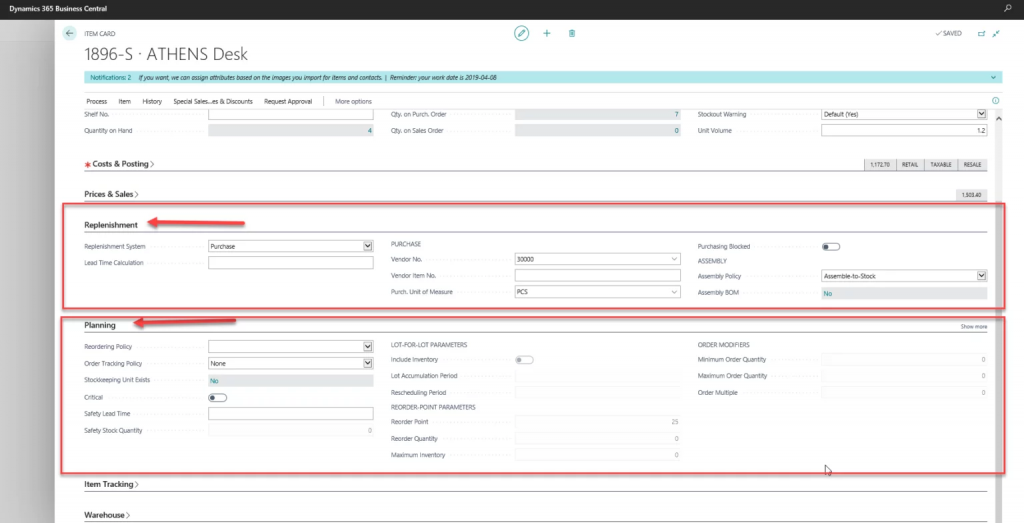

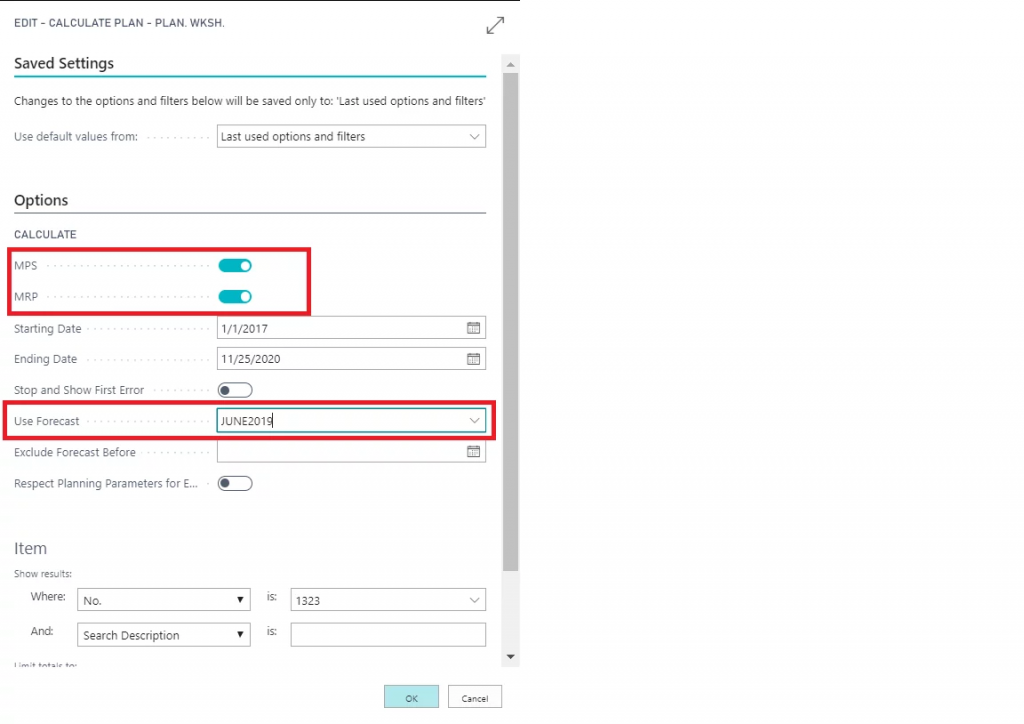

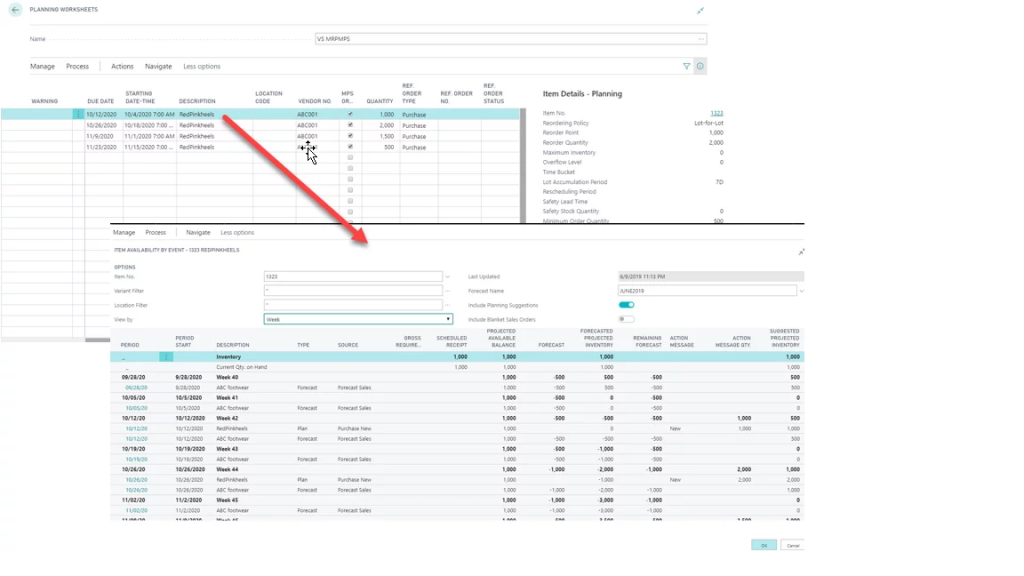

ERP stands for Enterprise Resource Planning and from the third word, it is obvious that planning plays a key role in the ERP systems and BC is not exceptional from this rule. Business central is equipped with a great planning engine which can help you to conduct your purchase orders, transfer orders and production orders automatically. For each item, you should select the replenishment system. It might be transfer, purchase or production based on your business requirements. It means how to supply your items? For instance for the vast majority of the raw materials warehouse, the replenishment system is a purchase, for the shop floor warehouse is transfer and for the finished goods is production. Another part of the planning is the order policy. You need to determine the order policy for your items. There are 4 different order policies in BC including Fixed Reorder Quantity, Maximum Quantity, Lot for Lot and Order. For some of your items, you should specify a reorder point and when the inventory level touches the point, the system can create an order to supply a fixed reorder quantity for the item and hence it can assure you not to see lack of the inventory level. The point is that you need to give the accurate data for your reorder point and the reorder quantity. Another order policy is the maximum quantity which resembles to the fixed reorder quantity, the only difference is that you should specify a maximum quantity and the system can assure that your inventory level is always upper than the reorder point and lower than the maximum quantity. The most common order policy is L4L and it is based on the BOMs and MRP. The final order policy is the Order and it is good for the rare and expensive items.

I would like to discuss about the Stockkeeping Unit (SKU). The BC is going to able to create multiple SKUs for each item. Let me give you an example to be cleared. Take into consideration that for a particular item, you have 2 different locations which have 2 different replenishment systems. The replenishment system for the location A is purchase and the replenishment system for the location B is transfer. In our example, you can define 2 various SKUs for the particular item and manage your purchase and transfer order, automatically. The requisition worksheet can cope with the purchase/transfer order and if you would like to run your production order, you should use the planning worksheet. You can also run MRP, MPS and demand forecast for your planning.